The Whisky Cask Market Overview 2020 has now been released

The much-anticipated Whisky Cask Market Overview 2020, produced in collaboration with Braeburn Whisky, has now been released, giving us an interesting snapshot of the general performance of the whisky cask investment market from January to December 2020. And the news for whisky cask investors is very positive.

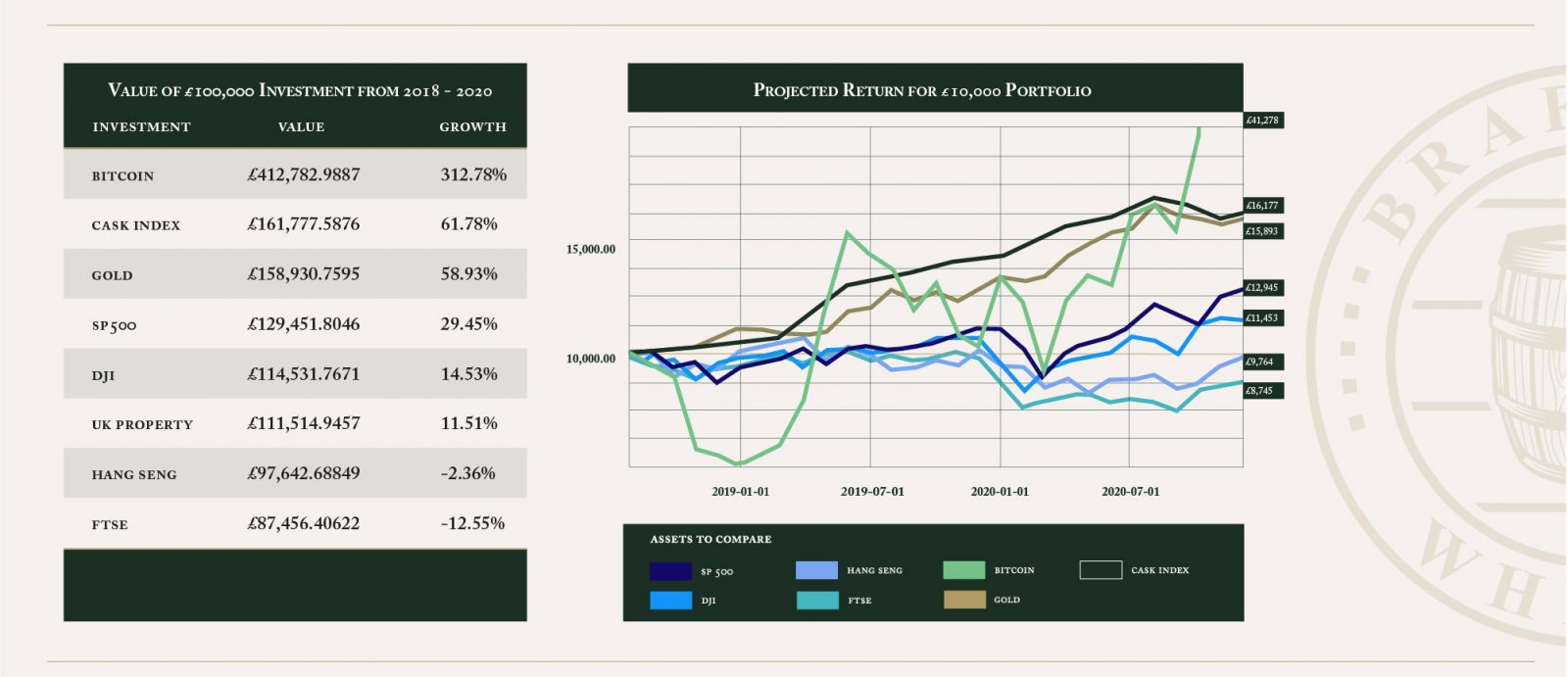

Among the headline figures, the continuing steady growth of Whisky Cask investment at 12.76% in a volatile market immediately catches the eye. Although very slightly down on the mid-year report’s figure of 13.09%, this performance continues to rank favourably against other tangible assets, like gold, as well as against traditional investments across the board.

Robust performance in uncertain times

For whisky cask investors, the news may not come as a surprise. The nature of whisky casks, which naturally appreciate and gain steady value as the spirit matures in the cask, make them a good investment choice to hedge against market volatility.

This pandemic has thrown many investment axioms up in the air, but one thing remains as true as ever: a tangible asset like whisky casks, untied to financial markets and with demand outpacing supply, offers investors a safe way to store and build their wealth in uncertain times.

For example, according to the report, a £10,000 investment in July 2018, would have been worth £16,178 for cask whisky in December 2020. For comparison, the same investment in gold would have reached £15,893 and in the best performing stock index, the SP500, it would have been worth £12,945.

Liquid gold continues to flow

Despite challenges in the whisky industry due to the global economic downturn, the whisky cask investment market continues to grow. The report reveals that the top 10 distilleries on the index had projected annual returns of 11.64%-17.71%, with not one of the distilleries in the index showing negative returns over the last five years. With an average compound annual growth rate of 15%, investors in top distilleries can expect to see their assets increase substantially for every 5 years that they hold on to their investment.

The report also includes a list of the top performing distilleries in Scotland, giving investors an important insight into the best places to put their money. Once again, the Laphroaig distillery holds top position, with the greatest average growth in cask value. Bunnahabhain and its peated variant, Staoisha, have swapped their positions but remain in the top three.

Interestingly, five of the top seven positions are occupied by Islay malts with Orkney malt Highland Park and Campbeltown malt Springbank sitting among the Islay whiskies in fourth and sixth place, respectively. Speyside distilleries bring up the rear of the top ten: long-standing favourite Macallan sits just above BenRiach and, new to the list, Glenrothes which concludes the table.

Overall, the report paints a remarkably stable picture of the performance of Scotland’s top distilleries, with only minor variations since the last report. This suggests an underlying solidity to the fundamentals of the Scottish whisky market and the casks that form the backbone of the industry.

Who is investing in whisky casks?

The Whisky cask investment market is expanding rapidly as more profiles of investors from different regions come on board. The report backs this up, quoting a February 2021 survey of investor confidence that showed a 25.4% increase in the number of respondents who had considered whisky as an investment asset compared to just six months ago.

This year’s report also took the opportunity to dig a little deeper into the question of whether younger investors are beginning to regard whisky casks as an interesting option to invest their money. The report found that millennials (aged 25-40) already make up around 30% of the whisky cask investment market. This could be the reason that the cask category that saw the biggest gain in 2020 was New Make, which offers an attractive price point for investors who are starting out on their journey.

Whisky Cask Market Overview 2020: Key Takeaways

- Robust growth: The BC20 Whisky Cask Index shows average annual growth of 12.76%. Even taking into account a slowdown across the board, the BC20 Index is still significantly higher than at any point in 2019.

- Notable stability:Whisky Casks seem to offer a relatively pandemic-proof investment option, outperforming property and stocks throughout 2020 despite a challenging global economy.

- Top performing asset: cask whisky and gold have both exhibited steady growth in comparison with other investment asset classes.

- Diversifying investors: the percentage of buyers who identified as female in 2020 was up by 36.38% from 2019. The percentage of Millennial buyers was up 55.75% from 2019.

- Top 10 Whisky Distilleries continue to perform: every distillery in the index exhibited positive projected capital growth throughout 2020.

- Islay malts stay strong: Laphroaig continues to top the Distillery League Table for casks, showing an average of 17.71% projected annual capital growth, and its neighbouring Islay distilleries continue to dominate the Top Ten.

- New Make surges: while most age categories saw a modest slowing of projected capital growth, the new make category witnessed an increase in projected capital growth.

What’s to come?

The bi-annual Whisky Cask Market Overview gives investors a wider picture of the fluctuations in the market and the historic trends that are slowly being revealed in this relatively new investment model.

As our minds turn to the coming months, some questions arise: As traditional markets start to stabilise, will we see continuing growth in alternative assets, like whisky casks? Which distilleries can we expect to emerge this year? And, how will the arrival of a new generation of investors impact the price of whisky casks over the coming months?

All will be revealed in the next Whisky Cask Market Overview!

If you would like to receive a copy of the 2020 Whisky Cask Market Overview please get in touch.

Find out more about how Whisky Cask Investment works here.