Data is the raw material of any investment strategy. Apart from identifying market trends, data-driven investments enable you to forecast potential risks and opportunities, helping investors to base their decisions on tangible information, instead of intuition or feeling. As more and more data is created every day, investors can leverage that information to build stronger portfolios.

Whether investing in stocks and shares or in tangible assets or cryptocurrencies, it’s crucial that you do the right amount of research so you know exactly where you’re putting your money.

From complex mathematical modeling and big data analysis to market reports and surveys, with such a wealth of information available nowadays, there’s no reason for an investor to make an uninformed decision.

But, how can whisky cask investors access the informative data that will help them to plan their strategies?

Not all data is created equal

Investors need to understand the different characteristics of their investments when looking for the data sources that will help them to boost their positions. For example, stock market investors can purchase software to carry out real-time market analysis; investors in gold can go online and look at historical trends to decide when to enter, or exit, the market.

But, when it comes to whisky cask investment, the availability of data to drive investment decisions has been relatively scarce.

That is, until now.

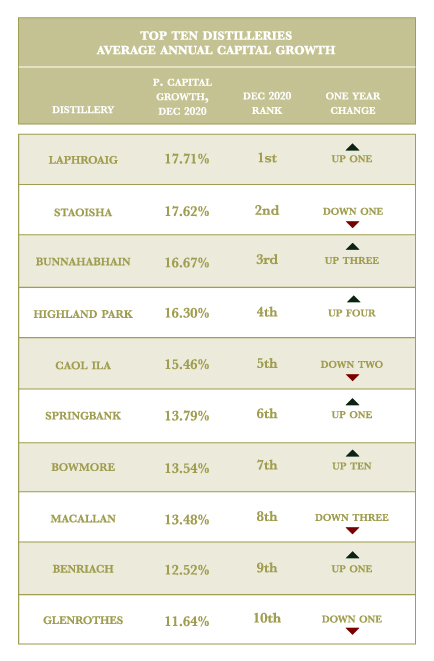

Reports like the BC20 Cask Index, collated by Cask88 and Braeburn Whisky can now call on solid, reliable data built on more than five years of market analysis across over 50 distilleries. In the case of Braeburn Whisky, the significant sales volume of cask investment products now provides enough raw data to be able to make more accurate forecasts. Braeburn Whisky is at the forefront of a fast-growing market in whisky cask investment: and there is a direct correlation between the amount of sales made and the quality of the data.

By using a selection of metrics derived from an algorithm built by the company to analyze movements across the market, we can now get a snapshot of the performance of the whisky cask industry as a whole.

A snapshot that can help investors make better, more informed decisions.

What kind of data should a whisky cask investor look for?

- Market trends. Reports like the BC20 Cask Index give an overall picture of the market. The strong trading volume across the selected distilleries provides enough raw data points to be able to that reflect performance and develop accurate projections for the whole market.

- Distillery growth. When choosing where to put their money, whisky cask investors should look at the performance of individual distilleries. A historical analysis of cask performance can help to model trends for the future.

- Cask type: The selection of casks available for investment can be studied for differentials in the comparative performance of designated age ranges (i.e new make vs. older casks) or casks types (ie. Sherry vs. Bourbon).

- Region: Whisky casks, like other kinds of tangible investments, can rise and fall in price depending on external factors, like fashions and popularity. The data shows that some regions perform stronger than others (i.e Highland vs. Islands), and investors can analyze that data before choosing where to purchase their casks.

- Comparative data. Taking a look at how whisky casks perform next to other investments can help you to calculate the projected value of your portfolio over time. By checking the performance of whisky casks against the S&P Index, for example, investors can begin to design a more diversified portfolio.

Historical trends mean accurate forecasts

There are similarities between whisky casks and other tangible investments, but the nuances inherent in the whisky cask market make it unique when it comes to collating accurate data. The greatest challenge facing investors is how to properly analyse a market where the assets are not treated as a commodity, but where provenance of the asset is of the utmost importance, and each cask has a set of characteristics that make it unique.

The value of whisky casks is not driven by economics alone, but by time as well. Given that whisky continues to mature while in the cask, a cask purchased today will inevitably become a more valuable asset over the years. Therefore, access to the right data can help us to forecast how much value specific casks can build over time.

Any investment analyst will tell you about the importance of basing your decisions on data. So next time you’re planning to invest in a whisky cask, make sure you have the right information first, before taking the plunge.

Want to find out more about the power of data for whisky cask investment? Get your copy of the Whisky Cask Report 2020.