The first post-pandemic report shows growth in the BC20 Index

The 2021 Whisky Cask Market Report has now been released, providing data on the performance of the whisky cask investment market in a year of uncertainty in global markets. Published by Braeburn Whisky and Cask 88, this annual report gives industry-leading insight into the state of the whisky cask market by tracking the BC20 Index and the average annual capital growth of cask investments from distilleries across Scotland.

The report, now in its fourth edition, provides a picture of the state of the whisky cask investment market by analysing data from more than 2000 casks comprising more than 65% of Scotland’s distilleries. The result is the most complete overview of the performance of the whisky cask market to date.

So, what are the key headlines from the latest report?

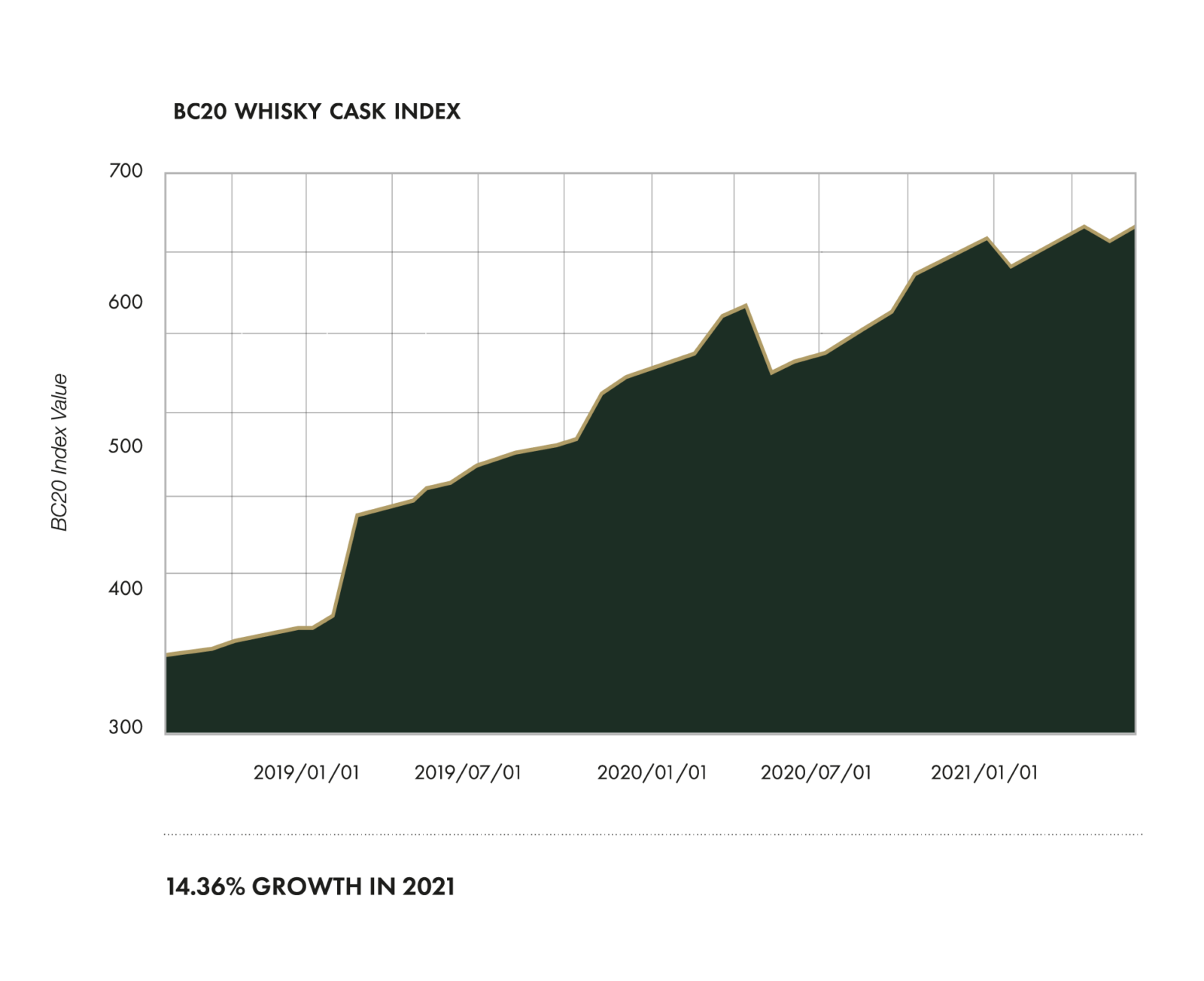

The BC20 Index grows to 14.36%.

The four previous reports reflected the remarkable stability of the whisky cask market, with fluctuations of around only half a percentage point despite the instability in global markets caused by the continuing global pandemic. However, the new report has now shown a significant jump for the BC20 Index of 1.4% in 2021. This is the largest yearly growth since this report began collecting data in 2020 and clearly reflects the rapid rise in awareness of whisky casks as a safe haven for investors in turbulent times.

It’s interesting to compare the performance of the BC20 Index with that of the overall cask market, which saw a more modest rise from 12.76% to 13.06% during 2021. Given the fact that the BC20 Index represents a select package of casks from a range of distilleries, the better performance of the index compared to the general average demonstrates the impact that selecting the right combination of casks can have on overall returns.

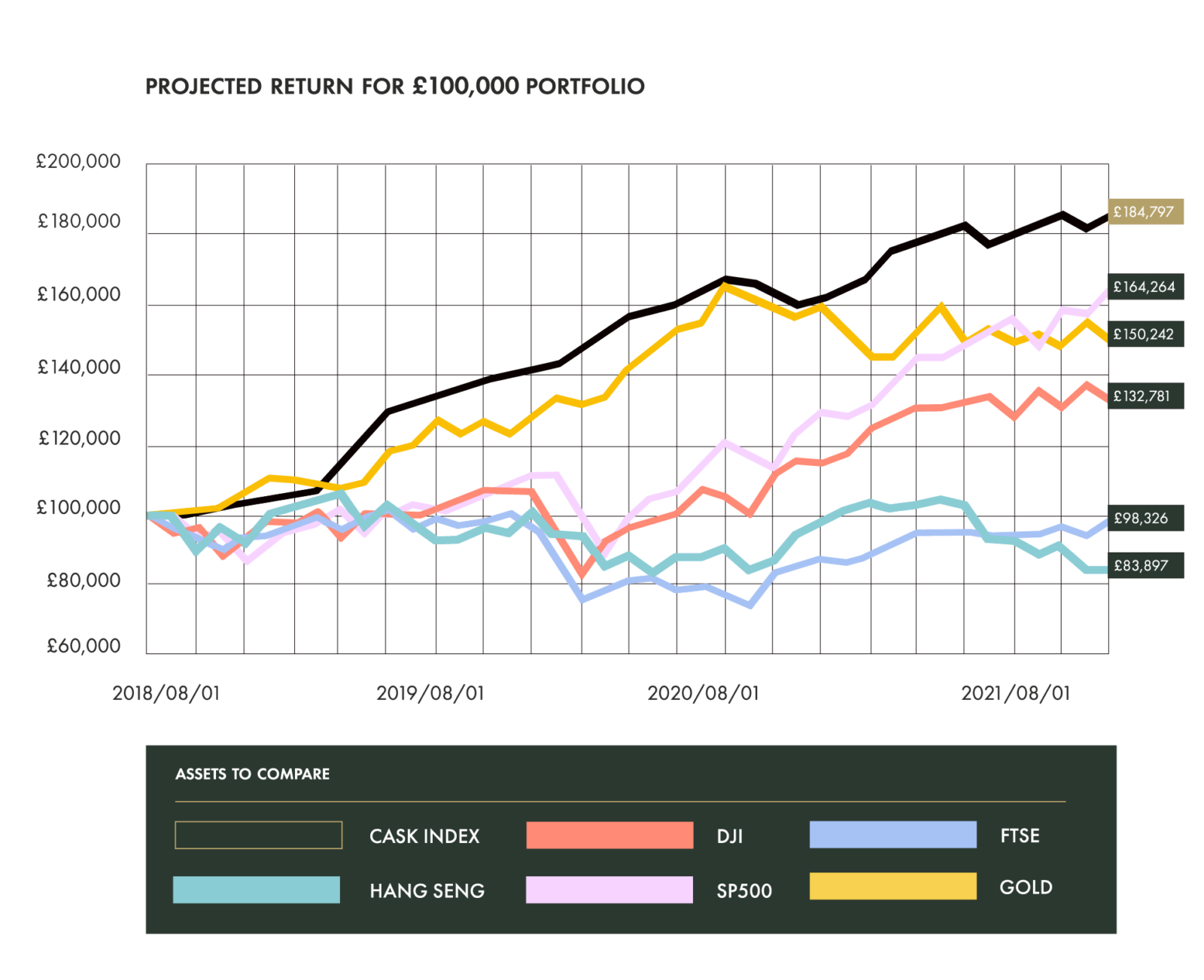

Outperforming other assets

The BC20 index continues to show the most stable and consistent growth among all the traditional and alternative asset classes mentioned in the report. During the first half of 2021, gold dipped slightly when investors moved their money back to stocks and shares as the economy recovered. However, investments in cask whisky were unaffected by the trend away from tangible assets and continued to rise above the average. Towards the end of the year, as the market entered an inflationary period, whisky casks grew further compared to traditional investments, as well as other tangible assets.

Clearly, whisky casks represent an increasingly attractive option for investors looking to diversify their portfolios to protect their wealth against inflation.

Little change among top distilleries

The 2021 Whisky Cask Market Report collected data from over 80 distilleries spread out across all of Scotland’s whisky-making regions.

There were few surprises in the data, with most of the top-performing distilleries from the last report featuring again. The table is led by Bunnahabhain, which has performed strongly over the last two years and has now taken top spot from its peated cousin Staoisha, which dropped down to fifth place. Highland Park performed well, just missing out on the top spot, while the ever popular Laphroaig occupied the third place on the list. The only new entry into the top 5 was the Speyside distillery Mortlach, which has shown the biggest jump of any of the top performing distilleries in 2021.

Whisky casks worldwide

The Whisky Cask Market Report 2021 introduced a new data set to reflect the expansion of the market globally. The data shows whisky cask investment gaining popularity worldwide, with the Asian market now becoming an important player in the market.

As expected, Europe leads the regional table with 70.97% of sales compared to 21.74% for Asia. In the regional country-by-country breakdown, the UK is the biggest market for whisky cask investors in Europe with 79.92%. In Asia, China leads the way with 48.14% of the total market in Asia.

More movement in the market

The trend towards investment in younger and New Make casks identified in 2020 intensified further in 2021. The lower price points and solid growth potential of these casks make them especially attractive to investors who are recently entering the market and looking to diversify their portfolios.

Younger casks offer greater percentage returns for those with the patience to wait, as well as more affordable initial investment. According to the data reflected in the last four reports, on average one can expect a recently filled cask to increase in value by 33% per year for the first three years of its lifetime. Cask choices at an older age will require a greater initial buy-in, as they are already in their prime, but every year are projected to yield a significant return in pure monetary terms. Demand for older casks is kept high by their rarity – a feature that intensifies with every passing year, as their stock gets bottled.

What have we learnt?

The first, and most striking, figure revealed in this report is the significant rise in the BC20 Index. Q2 and Q4 2021 reversed the slight dip at the beginning of the year (reflected in the previous Mid-Year Report) to record its most significant rise since the report started collecting data.

This rise in the BC20 Index seems to be a clearly correlated to the fluctuations in the global economy in 2021: a quicker than expected recovery from the pandemic, resulting in a Bear market at the beginning of the year, contrasted with a second half of the year characterised by growing pessimism, particularly related to inflationary pressures and issues around the supply chain and productivity.

A steady ship in rough waters

It’s clear that the strong causal relationship between economic uncertainty and a movement towards secure, tangible assets has had a positive impact on the value of the whisky cask market—however, what is perhaps more surprising is the whisky cask market’s continuing ability to outperform other traditional refuges, like gold.

The breakout performance of the BC20 Index compared to the average annual projected growth across all casks, alongside the surprising fluctuations seen in the the values of casks in some distilleries, underlines the importance of investing wisely with the help of data-based market analysis and expert advice.

The key takeaway from this data is the general stability of the whisky cask market compared with other investments, once again highlighting the potential of whisky casks as a hedge against both inflation and uncertainty.