1. Returns:

Whisky Casks Have Consistently Generated Robust Historical Returns

When evaluating an investment, history tells an important story. Each asset included in an investment portfolio needs to be grounded in data that demonstrates its earning potential over time. While all the other benefits are important, the number one reason to invest in whisky is quite simple… You can earn better returns.

Over the past 5 years whisky casks have generated an average return of 12.4% per annum, with popular distilleries delivering even greater advances. There are few tangible assets that can boast such robust levels of growth under every economic cycle.

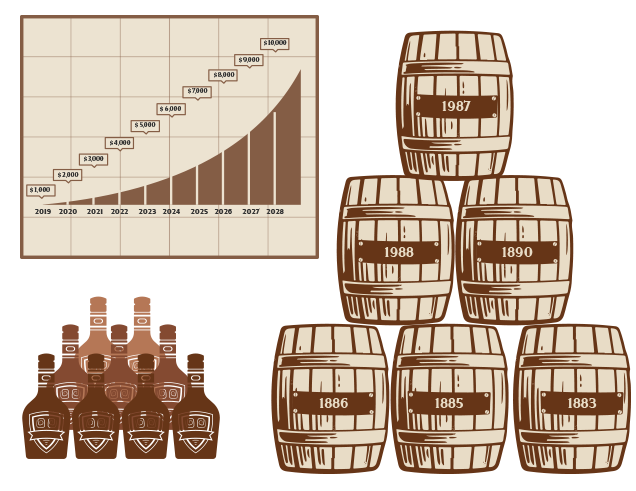

2. Maturation

Whisky Casks Grow Exponentially In Value As The Liquid Matures

One of the unique aspects of whisky cask investing is that the liquid continues to mature over time. In stark contrast to other tangible assets like precious metals, property or art; whisky contained in a cask naturally gets better with time. This powerful characteristic means that grow exponentially in value as the whisky is held in your portfolio. For each 5 years of maturation, an average cask will nearly double in value.

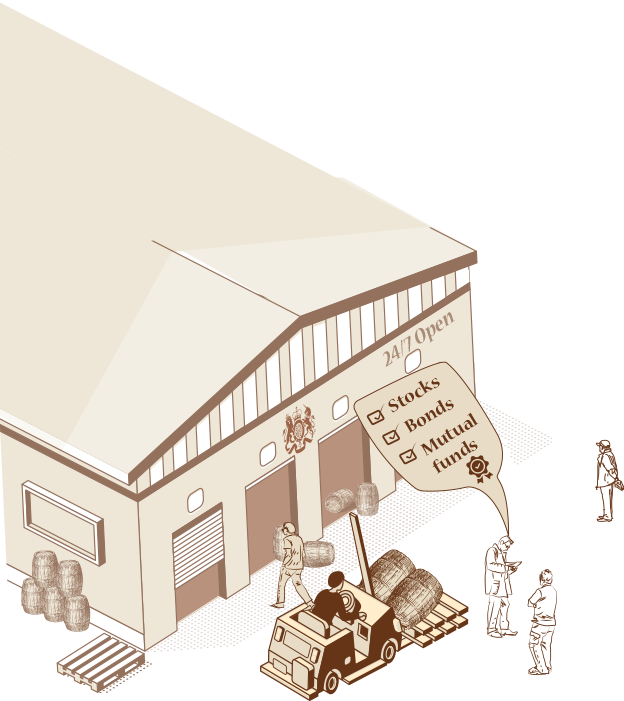

3. Tangible

Whisky Casks Are Tangible Assets With Real Intrinsic Value

In order to protect wealth, leading investors are placing increased reliance on tangible assets. In stark contrast to stocks, bonds, mutual funds and other “paper” instructions; tangible assets are an investment providing complete ownership and control. Whisky Casks are titled in your name and held in a government bonded warehouse, you can even visit the facility to view your holdings at any time. Whisky Casks move beyond tangible assets valued entirely based on demand, they have intrinsic value as well. No matter the economic condition, the whisky contained inside casks can be bottled and sold.

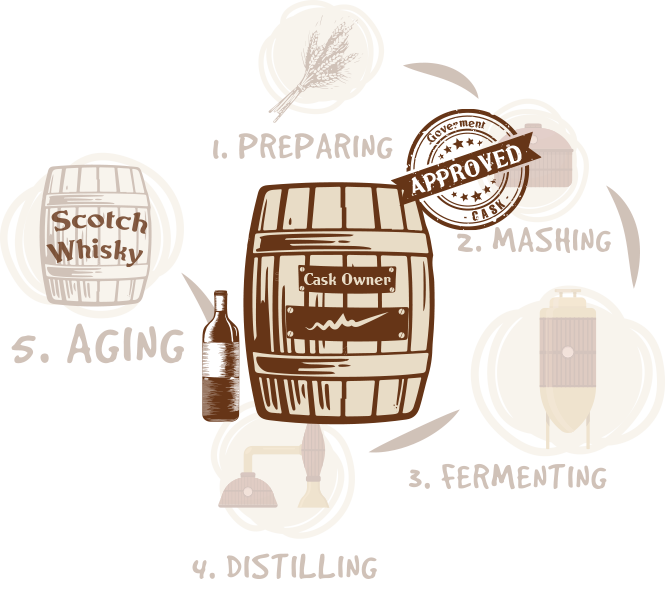

4. Provenance

Whisky Casks Cannot Be Forged Or Faked

Due to restrictions in place by the Scottish government, every cask of Scotch whisky must be held in a government bonded warehouse and carefully tracked from the time it is distilled. These regulations were established to ensure that every bottle that is labelled as Scotch Whisky can be verified as authentic and adhere to the strict standards adopted by the industry. While other tangible assets such as art and antiques have been plagued by forgeries and fakes, investors can have complete confidence in the genuine provenance of each whisky cask.

5. Liquidity

Whisky Casks Sell Very Quickly On The Secondary Market

Braeburn Whisky has access to an extensive network of cask buyers through independent bottlers, leading auction houses and connections with thousands of investors. There is always a pool of active buyers looking for casks to bottle or hold for further appreciation. Whenever an investor would like to exit a cask holding, they can initiate a sale at their desired asking price by simply clicking a button from their Braeburn Whisky online portfolio. Our team helps oversee valuation, payment, title transfer and all other aspects of the transaction.

6. Consumable

Whisky Casks Are Consumable

Yet another unique characteristic of whisky casks as an investment is their consumable nature. Each year, millions of casks are emptied and bottled for consumption by enthusiasts around the globe. This dynamic contributes to the economic power of whisky investment as the available supply of well matured casks gets depleted to produce bottles.

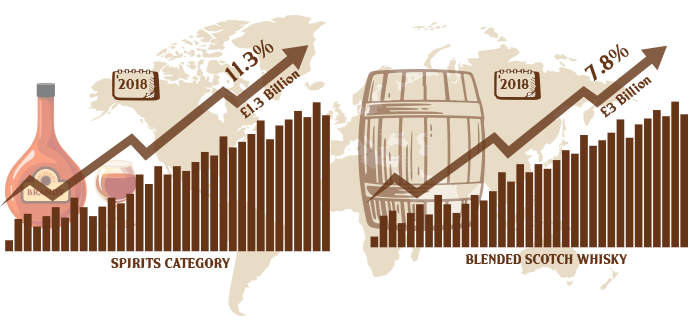

7. Surging Demand

Demand for whisky is growing worldwide

Exports of single malt scotch have continued to experience robust growth that shows no signs of slowing. In 2018, exports of the prolific spirits category experienced an outstanding gain of 11.3% to exceed £1.3 billion. Blended scotch whisky also experienced gains of 7.8% to now exceed £3 billion. Leading the charge is the United States market which became the first billion pound overseas market in 2018, with countries across Asia and America seeing outstanding rises as well. As demand for whisky continues to grow and distilleries struggle to ramp up production, the need for casks of matured liquid will only continue to increase across the industry.

8. Limited Supply

Supplies of well aged whisky are becoming increasingly scarce

The unexpected growth of the whisky industry over the past 10 years has kept distilleries running at full capacity, but it’s still not enough. Expansions are underway but these will not yield significant increases for years, and even then it will take decades before additional output could have a meaningful impact on available stocks. Cask investors stand to reap even greater returns over the upcoming years due to these production constraints.